HMRC’s multi-channel Digital Tax Platform

Cloud & Platforms

Public Services

5 min read

Key service areas

Platform-as-a-Service

Microservices

Open source

AWS

Her Majesty’s Revenue and Customs (HMRC) is a non-ministerial department of the UK Government responsible for collecting money for the UK’s public services and providing financial support to citizens. In 2012 HMRC set itself the goal of becoming a ‘digital by default’ organisation through, among other things, introducing digital tax accounts for all UK businesses and individuals in order to give customers a personalised user experience and an accurate, up-to-date picture of their tax affairs.

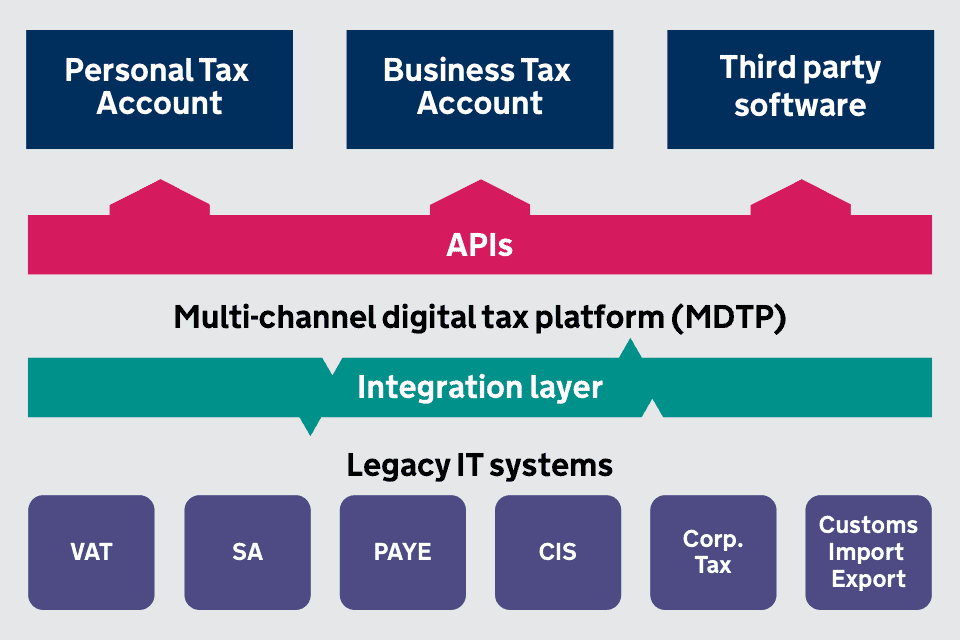

In February 2014 the means to bring this vision to life was launched – the multi-channel Digital Tax Platform (MDTP), a cloud Platform-as-a-Service (PaaS) hosting the new digital services and providing connectivity via an integration (API) layer to the legacy back end. This enabled HMRC to adopt a consistent approach to the way it provided modern customer-facing services, with MDTP providing the business with a secure, highly available, performant and scalable home for their services, with service teams following a Continuous Delivery approach to develop and deploy microservices quickly, frequently and safely. MDTP was built using a collection of open source technologies, further enabling ownership and decreasing reliance on expensive, proprietary tech.

Due to the need for customer data to be hosted in the UK, HMRC was not able to immediately follow its desired path of launching MDTP on hyperscale cloud – for the first two years MDTP was hosted with a single datacentre provider, then from January 2016 across two single datacentre providers, finally migrating to a cloud solution Amazon Web Services (AWS), environment by environment, in October 2017.

Customer contact is primarily digital but other channels, namely virtual assistants, phone, secure messaging and web chat, are integrated with the digital services and managed through a separate Contact Platform.

MDTP follows a multi-partner model to extract the utmost value out of different vendors and skill sets, with all platform teams comprising two or more suppliers (i.e. ‘blended’) . As part of this initiative, esynergy was brought in to form part of the team that builds and operates the new tax platform.

Today, MDTP is the most advanced PaaS in the UK public sector, seamlessly servicing over 1bn requests in the 24-hour period through 31st January 2019. The truly hyperscale, automated and state-of-the art platform has seen the overall team size remain the same since mid-2017, while the volume of traffic and the number of Production deployments – currently around 600 per month, not including the automated self-healing deployments – have been steadily increasing.

Cloud & Platforms

Public Services

Igniting Technological Innovation