Today’s banking customers expect nothing less than a seamless, real-time experience across all channels. As a result, banking business models are shifting from products to experiences.

As many traditional banking products become embedded into the customer journey, it’s the overall experience that becomes the cornerstone of a customer’s relationship with their bank.

But many banks struggle to connect their different products, data and channels in a way that enables truly sophisticated customer experiences. The problem is that they are running into the limits of their existing product-centric approach.

The product approach is all about finding ways to identify and prioritise customer needs and systematically build solutions for those needs. But it tends to focus on individual products, at the expense of the wider view, i.e. the business-wide connections that make the modern, seamless, real-time customer experience possible.

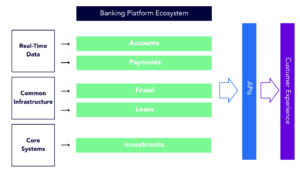

Platform ecosystem offering an ecosystem of interconnected services

The product approach isn’t wrong. Far from it. It just needs to be taken a step further.

This is where platform transformation comes in.

What is Platform Transformation?

Platform transformation is an evolutionary step towards a deeply interconnected, flexible, modular digital technology platform that can enable innovative customer experiences and bring them to production faster and more frequently.

Instead of having a set of separate, self-contained products and features, there is an adaptable ecosystem of capabilities and building blocks upon which products and features are built and through which they are connected.

A platform is designed from the ground up to help connect different products, tools, teams, data and so on. It’s like a stable centre of gravity for your technology stack.

And this is an indispensable pillar for any bank that wants to provide a modern customer experience in a sustainable and scalable way.

By building a flexible core banking platform at the centre of your business, you can harmonise your existing applications and data, while leaving room to add or subtract new applications, tools and data as your business grows and changes, without having to start from scratch or bother with messy migrations.

The resultant ecosystem is capable of the kind of highly-scalable real-time, multi-channel connectivity that modern banks need.

Core Pillars of Platform Transformation

So, what goes into making a platform? Very briefly, the core pillars of a platform encompass people, processes and technologies.

People

The key here is to organise your people in a horizontal fashion, rather than vertically. This means a set of independent, cross-functional agile teams that combine business, engineering and product expertise with end-to-end accountability.

Process

Vertical Operations: Individual teams look after their stage of delivery lifecycle, resulting in multiple handovers, miscommunications and delays

Horizontal Operations: Cross-functional teams have end-to-end accountability, drawing on common resources.

A new operating model is required to move your business from siloed, vertical operations to integrated, horizontal networks that mirror the structure of your technology platform. Customers (internal and external) must be at the heart of any such shift, with clear business outcomes underpinning all development.

Technology

The public cloud is the indispensable cornerstone of any platform. By leveraging decentralised computing, automation, APIs and so on, rapid and frequent code releases can become the default.

Similarly, common standards for security and compliance, shared design patterns, on-demand interoperable services, heavy automation and so on create essentially a ‘royal road’ to production for developers, massively accelerating the delivery lifecycle.

The Impact of Platform Thinking Versus Product Thinking

The reason platforms are so powerful is that they provide a stable developer ecosystem to support them to create new products and services at speed and scale as well as adding additional value by bringing together different business elements (teams, data, processes etc.).

What does your bank look like when it evolves towards a platform approach? How does it change? Here are some key differences that emerge when you move from product to platform thinking:

- Siloed applications > integrated operations

The narrow focus on individual applications is left behind. By leveraging APIs you can seamlessly integrate applications and data from across your business - Domain-specific capability > multi-channel capability

By integrating disparate apps, tools and data by default, the problem of differentiated customer channels is not so much solved as made irrelevant. - Slow pace of change > rapid innovation

The developer ecosystem makes frequent releases (and roll-back!) of small chunks of code straightforward, enabling rapid experimentation and innovation. - Siloed data > available data

By connecting your entire business via your platform, data no longer needs to be centralised, which is a bottleneck. Instead, valuable data products can be created anywhere and consumed from anywhere. - Specialised teams > cross-functional teams

Rather than teams operating in specialised verticals, cross-functional teams are able to take an idea all the way to production without handovers. - Inconsistent security > security-by-default

Common platform security standards can be automatically embedded by default into your platform infrastructure as well as the code that is deployed on it.

What does this look like from a birds-eye view?

In the product world, a bank might listen to customer needs, conceive of a new product to meet them, build and release the whole thing in one fell swoop and then teach the customers (internal or external) to use it. This sounds reasonable, but it ends up being too slow and monolithic. By the time you’ve finished the product, the customer has moved on!

In the platform world, software is no longer delivered as massive, individual (and separate!) blocks. The platform ecosystem enables you to incrementally add or subtract new features at speed and high frequency, without impacting any other services.

In this sense, platform thinking emerges when you take product thinking and take it a level higher. You have essentially created a meta-product that helps you build, scale and improve your other products more easily!

Barriers to Platform Transformation

If platforms are so great, why aren’t more businesses taking this approach? This is because enterprise IT is a complex beast that carries a huge amount of inertia. It takes substantial momentum to execute big shifts of any kind.

At esynergy, we’ve seen many businesses attempt to transition to a platform approach, but few end up being successful. The following are some of the major barriers that we see businesses struggling with:

- Lack of support within the business

Your people need to be convinced that it’s worth their time to change from old, comfortable to new, less-familiar ways of working. Unless you win the hearts and minds of your people you will struggle to move the needle. - Weak business case

In order to win support, you need to make a powerful business case for change. Try a lighthouse project to demonstrate the value of platform approaches and get a mandate to further investment. - Lack of technology capabilities

Platform approaches demand substantial technological sophistication that many firms lack: mature cloud infrastructure, very high levels of automation, democratised data, excellent data/security governance and so on. These are the heart of the modular platform architecture that enables rapid code releases at scale. - Lack of skills

These technology capabilities require in-demand skill sets that can be difficult to find. Businesses need to invest in a powerful employee value proposition to attract talent and/or find partners that can fill some of those skill gaps.

Enterprises need to make sure that they have the foundational resources in place – people, technology, data and so on – before they can embark on the platform journey.

But if they can make the transition, the business benefits are substantial.

The Business Benefits

An open, connected, modular, integrated platform approach creates a huge amount of real business value:

- Accelerated delivery: get to market faster, without compromising on security, cost or quality

- Share critical business capabilities: empower commercial SMEs to build new products

- Enable experimentation: new ideas can be rapidly developed, tested and iterated

- Data-driven CX: put data at the heart of everything your business does to deliver personalised customer experiences

- Broad business insight: get a comprehensive view of your data

Ultimately, however, a platform approach gives you a banking superpower that a product approach simply could not.

The ability to give the modern banking customer what they want: real-time seamless, integrated customer experiences across all services, devices and channels that can be sustained in the long term.